Friday’s Insider: Three shadows of ammonia — grey, blue, green

Another week, another headline shakes the fertilizer world—Yara’s decision to phase out ammonia production at its Tertre plant in Belgium.

Yara’s move signals a shift towards premium nitrate fertilizers, but it also highlights a larger trend: the EU’s steady march towards full dependency on imported fertilizers. This shift isn’t just about market preferences; it’s a direct result of the immense challenges European producers face when it comes to costs, taxes, and regulations.

Let’s dig into the real obstacles. The biggest burden for nitrogen fertilizer producers in Europe is energy, specifically natural gas, which lies at the heart of ammonia production. With the price of natural gas rising and fluctuating, production becomes increasingly expensive. But the pain doesn’t stop at gas prices. The EU’s carbon taxes, part of the Emissions Trading System (ETS), have reached around 90 euros per tonne of CO2. This adds a significant cost to every step of the production process, especially in energy-intensive industries like fertilizers.

On top of this, there are VAT rates applied to raw materials and energy inputs. In Germany, for instance, VAT sits at 19%, while in Spain, it’s 21%. These taxes on inputs, particularly on natural gas, compound the already high costs of production. Then there’s the excise duty on natural gas itself—France charges 8.45 euros per MWh, and while Germany’s rate is lower at 1.38 euros per MWh, it still represents a burden for producers trying to manage costs.

Environmental levies also come into play. Fertilizer producers in the Netherlands pay a waste management tax of 13 euros per tonne, while Spain adds a water usage fee of 0.29 euros per cubic meter. The costs are coming from every direction, and European producers are finding it harder and harder to keep up.

While European producers are struggling, countries like Egypt are gearing up for significant changes in their fertilizer industry, especially with the shift from grey ammonia—produced using natural gas—to green ammonia, which is made using renewable energy sources. This transition is part of Egypt’s larger effort to reduce carbon emissions and align with global sustainability goals by 2030.

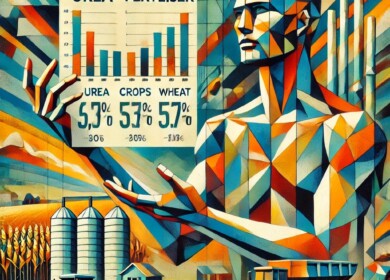

The big question is: how will this shift impact the cost of production in Egypt, where natural gas has traditionally been a more affordable energy source? Grey ammonia has long been the go-to option for fertilizer production in Egypt, with costs hovering between $300 to $400 per metric tonne. These costs are largely influenced by global supply and demand for natural gas, as well as local subsidies and energy policies.

Green ammonia, on the other hand, comes with a higher price tag—globally, the cost ranges between $600 to $800 per metric tonne. However, Egypt, with its vast potential for renewable energy from solar and wind, could see production costs closer to $600 per tonne. Even so, that’s still $200 to $300 more expensive than grey ammonia, which poses a significant challenge for an industry already operating on tight margins.

Is the transition to green ammonia unavoidable? It’s hard to say. While it’s clear that the global shift towards sustainability is inevitable, the speed of that transition depends heavily on technological advancements and infrastructure investments. Egypt’s abundant solar and wind resources give it a natural advantage, and as renewable energy infrastructure expands, the costs of green ammonia production should decrease. But for now, the gap remains wide, and producers will need to weigh their options carefully.

In the middle of this debate, another player enters the scene: blue ammonia. Blue ammonia, like grey ammonia, is produced from natural gas but incorporates carbon capture and storage (CCS) technology to reduce emissions. It’s seen as a sort of bridge between grey and green ammonia. However, blue ammonia isn’t cheap. The added costs of carbon capture push production prices to around $450 to $800 per metric tonne. Yet, in regions where government incentives or carbon credits are available, blue ammonia could become a more viable option.

This brings us back to the bigger picture: the global fertilizer industry is at a crossroads. Whether in Europe, where producers are bogged down by high energy prices, carbon taxes, and environmental levies, or in Egypt, where the shift from grey to green ammonia is both a challenge and an opportunity, the industry is being forced to adapt.

With mounting pressure to reduce carbon emissions, the future of ammonia production is leaning towards blue and green alternatives. The big challenge for producers, regardless of their location, will be finding the right balance between short-term costs and long-term sustainability goals. For some, the transition will require careful planning and significant investment. In Europe, where survival is becoming more difficult, strategies need to shift from just staying competitive to staying afloat. In Egypt, the transition to green ammonia could eventually close the cost gap, especially given the country’s renewable energy potential.

The pace of change will vary by region, but one thing is certain: the fertilizer industry is undergoing a fundamental transformation. What was once a matter of cost efficiency is now a question of sustainability and long-term survival. Producers who can manage this shift effectively will not only survive but thrive in this new landscape.

In the end, this isn’t just about changing production methods—it’s about a complete strategic pivot. Producers need to carefully consider where they stand and what resources are available to them, as the industry continues to move towards a more sustainable future. How quickly the cost gap narrows between grey, blue, and green ammonia will depend on the region, the availability of renewable resources, and how well producers can adapt to this evolving market.

————

About the Author of “Friday’s Insider”: Ilya Motorygin is the co-founder of GG-Trading and brings 30 years of experience to the fertilizer industry. Renowned for his comprehensive problem-solving skills, Ilya expertly manages deals from inception to completion, overseeing aspects such as financing, supply chains, and logistics.

Enjoyed this story?

Every Monday, our subscribers get their hands on a digest of the most trending agriculture news. You can join them too!

Discussion0 comments