Navigator Gas expands fleet with new liquefied gas carriers

Navigator Holdings, commonly known as Navigator Gas, has placed an order for two 48,500 cubic meter liquefied ethylene gas carriers (LEGCs) from China. These vessels, designed to be among the largest in the world for their class, will be constructed by Jiangnan Shipyard (Group) in collaboration with China Shipbuilding Trading. The cost per vessel is approximately $102.9 million.

In addition to the two initial ships, Navigator Gas has secured an option to order two more vessels of the same specifications and price, with potential delivery scheduled for November 2027 and January 2028, should the option be exercised. The two initial vessels are expected to be delivered in March 2027 and July 2027, respectively.

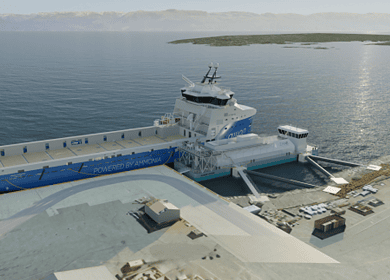

The new vessels will be equipped to carry a wide range of gas products, including complex petrochemical gases such as ethylene and ethane, as well as liquefied petroleum gas (LPG) and clean ammonia. They will feature dual-fuel engines optimized for ethane, a low-carbon transitional fuel, and will be retrofit-ready for future use of ammonia as a fuel. The vessels are also designed to transit both the old and new Panama Canal locks, offering increased operational flexibility.

Navigator Gas noted that these vessels will strengthen the connection between its ethylene export terminal at Morgan’s Point and its global customers. The company highlighted that the new ships would enable it to maintain a safe, efficient, and reliable ethylene transportation capability that is competitive and future-ready, with assets adapted to the low-carbon fuel landscape.

Navigator Gas plans to finance the new vessels through a combination of cash reserves and new debt, without issuing additional capital. Although the newly ordered ships have not yet been chartered, the company intends to secure charters prior to their delivery.

Earlier in the month, Navigator Gas secured up to $147.6 million through a secured term loan and revolving credit facility with Credit Agricole Corporate and Investment Bank, ING Bank, and Skandinaviska Enskilda Banken. These funds will be used to repurchase the Navigator Aurora vessel and for general corporate and working capital purposes.

Additionally, in early August, the company announced a co-investment in Ten08 Energy, a clean ammonia development project located on the Gulf Coast of Texas. This project aims to establish an industrial-scale hybrid blue and green ammonia production and export facility. The goal is to produce the most competitively priced ammonia molecule to support the decarbonization efforts across the power, shipping, fertilizer, and chemical industries. This initiative further aligns with Navigator Gas’s strategy to invest in sustainable energy solutions and reduce carbon emissions within its operations.

Enjoyed this story?

Every Monday, our subscribers get their hands on a digest of the most trending agriculture news. You can join them too!

Discussion0 comments