Mosaic reports challenging Q2 2024 financial results

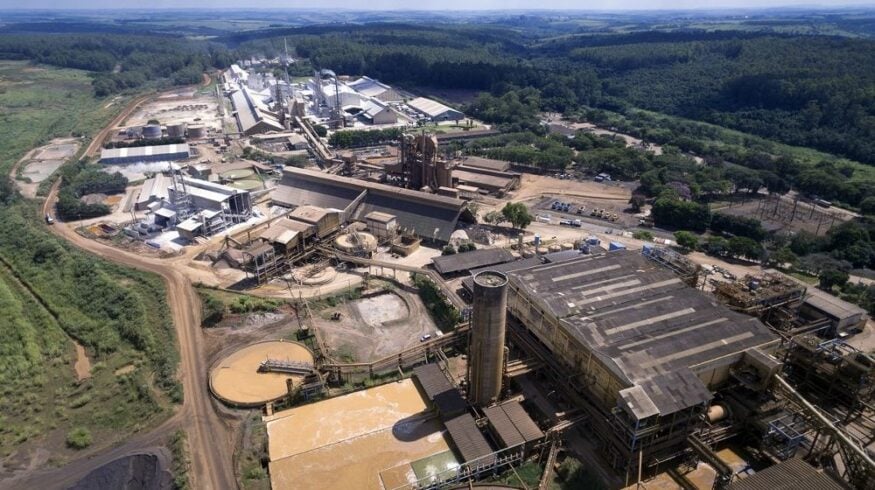

One of the largest US fertilizer producers, The Mosaic Company, disclosed a net loss of $162 million for the second quarter of 2024, marking a significant downturn from the net income of $369 million reported in the same period last year. The results, heavily impacted by a variety of notable factors, including foreign currency transaction losses and unrealized losses on derivatives, contrast sharply with Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $584 million.

The quarter saw Mosaic navigating a complex market environment characterized by lower selling prices and subdued demand in certain segments. Total revenues declined to $2.8 billion, a 17% drop from the previous year, with gross margins also shrinking from 17% to 14%.

Despite these challenges, the company reported several positive developments. Phosphate production volumes rose by nearly 100,000 tonnes sequentially, reflecting efficiency gains from recent operational improvements. In the potash segment, although prices fell, production increased, and unit costs were reduced. This was partially due to the restart of the Colonsay mine in July, aimed at boosting supply in anticipation of increased market demand following new contract settlements with China and India.

Significantly, Mosaic’s strategic growth initiatives appear to be bearing fruit. The company’s Mosaic Biosciences division expanded its reach to 5 million acres across North and Central America in the 2024 crop year. This growth aligns with Mosaic’s broader aim of enhancing its product offerings and market penetration.

From a financial perspective, Mosaic remains committed to returning value to shareholders. In the first half of 2024, $298 million was returned, including $160 million through share repurchases. The company is also making headway in its cost reduction plans, having achieved significant savings compared to the previous year.

Looking forward, Mosaic expects the agricultural fundamentals to remain robust, supported by low global stock-to-use ratios for grains and oilseeds and favorable weather conditions anticipated from the transitioning El Niño to La Niña phase. This environment is likely to sustain demand for fertilizers, although the company remains cautious about the ongoing geopolitical and economic uncertainties impacting global markets.

In conclusion, while Mosaic faces short-term headwinds with its financial performance, strategic initiatives in production efficiency, cost management, and market expansion are laying the groundwork for improved outcomes in upcoming quarters.

Enjoyed this story?

Every Monday, our subscribers get their hands on a digest of the most trending agriculture news. You can join them too!

Discussion0 comments